You’ve arrived in Germany as an Azubi, ready to start your journey and settle into your new life. You’ve got your workplace and study schedule sorted — but there’s one key question left: How do you get paid? Which bank should you use? And more importantly, which ones are foreigner-friendly?

To help guide you in the right direction and ensure you don’t miss your first payday, we’ve compiled a list of recommended banks that are known to be accessible and easy to use for newcomers.

But first — before opening a bank account, it’s crucial to get a German SIM card and register it. This step is essential, as most banks require a registered phone number for verification during account setup.

Germany has a wide range of mobile network providers, but to make your choice easier, we’ve put together our Top 5 SIM card options to get you started.

Once your SIM card is active and registered, you’ll be ready to open your German bank account and take the next step toward financial independence in your new home.

Revolut is a digital banking platform that offers a wide range of financial services through its mobile app, including multi-currency accounts, debit and credit cards, stock and cryptocurrency trading, international money transfers, savings accounts, and loans. We have noticed that most South Africans who have just recently moved to Germany use this bank.

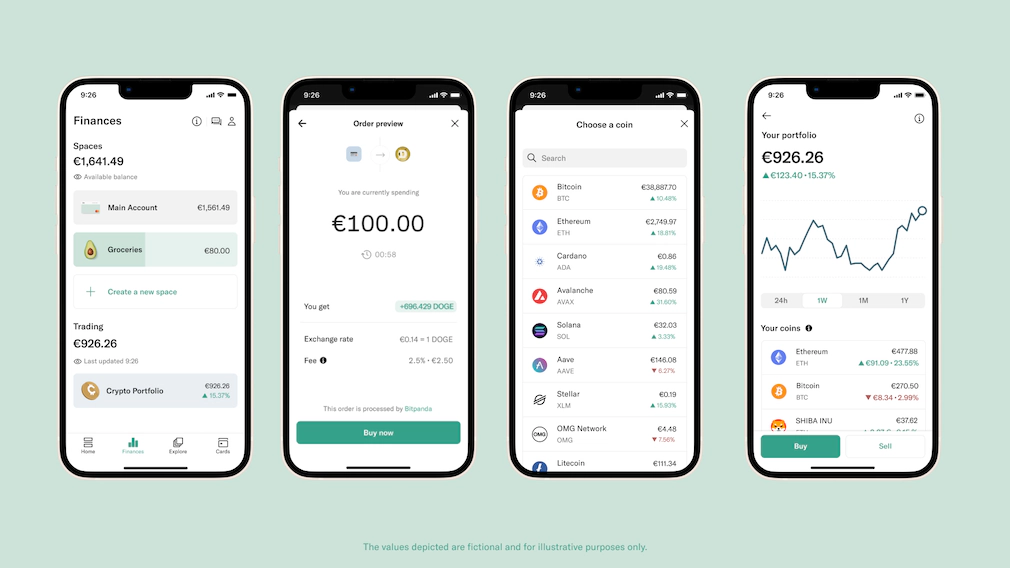

N26 is a German digital bank that offers a range of financial services through its mobile app, including personal and business accounts, debit cards, savings accounts, investments, and cryptocurrency trading.

Once you’ve chosen the bank you’d like to use, follow the registration process step by step. To complete your registration, you’ll need your South African passport and the address of your accommodation in Germany.

Please note: Before you can receive any payments into your new account, you must provide your tax identification number (Tax ID). The banking platform will prompt you to enter this. Your employer is responsible for sending your Tax ID to you by mail.

After your account is fully set up and you’ve received your Tax ID, submit your new bank account details (also known as your IBAN) to the HR department. Then, all that’s left to do is wait for payday!

If you wish to get more information and more advice, feel free to email us on info@x-factoredyouth.co.za

Leave a Reply